Silom Partners Tax Corporation

Silom Partners Tax Corporation provides professional domestic and cross-border taxation, accounting and associated consultancy services. By working closely with SLPI group companies in Japan and elsewhere, we are able to provide an unprecedented comprehensive service across a range of fields including taxation, legal advice and HR.

Comprehensive suite of business taxation and accountancy services

The rapid globalization of industry and the increasing complexity of corporate dealings present unprecedented challenges for business in the modern world. Silom Partners Tax Corporation provides professional advice and guidance on a broad range of business matters, including standard taxation queries as well as more complex issues in relation to financial management, HR and company law. Regular on-site consultations are used to monitor client expectations, solicit feedback and evaluate implementation. We have a particular focus on building constructive relations with financial institutions to facilitate funding procurement. With a wealth of experience and expertise in financial statements and cash flow analysis as well as a patented time series analysis technique, we are ideally positioned to help businesses access the funding they need to ensure ongoing operational stability.

What we offer

- Up-to-date tax report preparation and filing

- Financial audits

- Silom Partners Tax Corporation will prepare financial reports and statements that explain the financial health of the organization, identify weaknesses or issues to be addressed, and provide context for credit ratings from financial institutions. This information is used to advise clients on future strategies.

-

Typical financial reports

Unique financial analysis

Key weaknesses/challenges

Unique cash flow analysis

Error audit

Trial balance and cash flow calculations

Settlement forecast -

Typical time series analysis reports

Trending patterns, seasonal fluctuations

Expenditure shift correlation analysis

Performance forecast and financial stress test based on time series analysis

-

Typical financial reports

- Tax minimization and funding procurement strategies based on performance forecast

- Silom Partners Tax Corporation will prepare financial reports and statements that explain the financial health of the organization, identify weaknesses or issues to be addressed, and provide context for credit ratings from financial institutions. This information is used to advise clients on future strategies.

- Assistance with tax audits including on-site presence

Taxation experts will maintain an on-site presence during a tax audit to provide advice and assistance for any and all eventualities. Our primary aim is to ensure full protection of client rights and privileges. We help clients to implement meaningful improvements rather than superficial or cosmetic modifications."

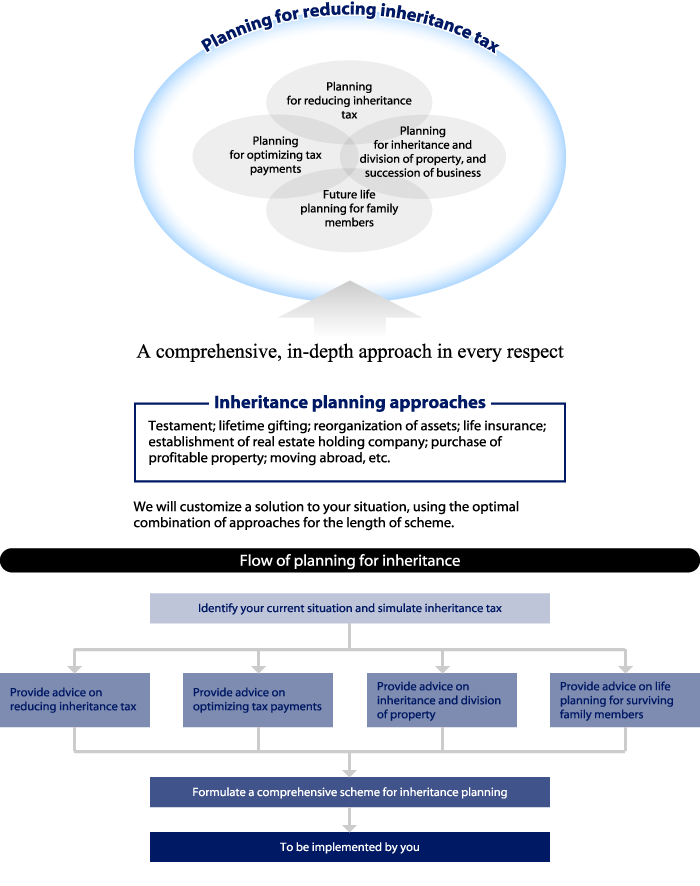

Inheritance and succession planning, inheritance tax reporting requirements and other inheritance-related consulting

The professional team of tax consultants at Silom Partners Tax Corporation is committed to ensuring that the assets that you have worked your whole life to produce pass safely into the hands of those you nominate.

1. Inheritance and succession planning

A recent shift in thinking around inheritance tax rates has led to rising anxiety about the possibility of a tax hike. But the inheritance tax rate is not the only concern when it comes to inheritance. At Silom Partners, we boast a wealth of experience in coordinating inheritance regimes.

“The inheritance tax is just a sum of money to be paid. No amount of money will regain lost trust of your loved ones.”

In order to minimize inheritance taxes payable in the future without resorting to deferment or payment in kind, we must search for financial resources now. This is also a good way to minimize devaluation of the assets we have worked all our lives to accumulate so that they can be passed on to family members and provide financial security for the next generation.

At the same time, the reality is that family members often end up squabbling over inheritance issues, with inequitable allocation of assets not uncommon, and this, conversely, can lead to instability and lack of financial security.

Inheritance planning therefore involves more than simply trying to minimize inheritance taxes; it is important to develop multifaceted strategies to maintain harmony between family members while providing financial security into the future.

- Analyze the current family structure and asset portfolio and run a simulation on how a hypothetical inheritance would play out at the present point in time

- Use the simulation to determine the optimum time-frame for the inheritance strategy, taking into account the age and health of family members

- Investigate tax minimization strategies such as asset restructuring, inter vivos gifts (gifts bequeathed while still alive) and life insurance policies

| Inter vivos gifts | Inter vivos gifts are typically made in the form of cash, insurance payouts, shares in the family company or other assets. Gifts may even be extended to grandchildren or spouses. |

|---|---|

| Restructure assets | It may be possible to convert some of your current assets into forms that are led to reduction in the amount of inheritance tax payable, such as real estate and life insurance. For example, financial assets and loans from financial institutions could be used to purchase an apartment or other property, which significantly reduces the amount of inheritance tax payable. |

| Set up a real property holding company | If you currently own property, you can transfer it to a corporation and arrange to have revenue generated from the property disbursed to children or family members over a defined period, thereby avoiding any unwanted future increase in inheritance assets. |

| Transfer assets overseas | In some cases, it may be more profitable to relocate overseas and transfer assets at the same time. |

- Tax payments can be made using life insurance, via the future sale of assets or, if you own a company, from a deceased employee retirement payout.

- Preparing a Will helps to ensure that your assets are distributed according to your wishes, free from encroachment by other parties. A properly constructed Will can also help to avoid potential taxation issues. The Will should ideally feature additional provisions designed to accommodate future changes in circumstances.

- It is important to ensure that the distribution of your estate in accordance with your wishes provides an adequate level of financial stability for family members into the future.

- The final details of the inheritance scheme are drawn up on the basis of a range of factors.

- The inheritance scheme is implemented.

- It may be appropriate to seek additional input into the inheritance scheme from Silom Partners Tax Corporation and other arms of the SLPI group such as legal advisers, judicial scriveners and overseas accounting offices. We can also provide an inheritance simulation at no cost.

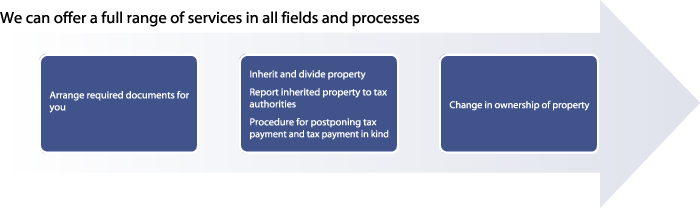

2.Inheritance tax declaration

Inheritance tax declarations prepared by Silom Partners Tax Corporation offer two key benefits.

- One-stop advice and assistance on a wide range of issues ranging from documentation for inheritance tax declarations through to potential future secondary inheritance scenarios; optimal distribution of the estate predicated on the “life design” of family members; and procedures for transferring ownership of assets after an inheritance declaration has been filed.

- Silom Partners boasts considerable experience with cross-border inheritance procedures, most frequently involving assets in the United States, Taiwan, Hong Kong and China. We can help with transfer of ownership of overseas assets, typically where the inheritor or inheritee resides overseas, or some of the assets are held overseas, or a wealthy individual has been actively engaged in foreign investment.

Corporate restructuring

Setting up a separate holding company via a merger, partition, stock exchange or stock transfer is traditionally associated with large enterprises, but it is an equally effective technique that small and medium-sized businesses can use to generate operational efficiencies. Recent years have seen a trend towards the use of holding companies by business owners to facilitate succession planning. Unfortunately, corporate restructuring is governed by a system of arcane and complex rules and regulations, and the corporate tax burden can potentially be higher if the restructuring is not planned out carefully. To avoid potential pitfalls, be sure to speak to Silom Partners Tax Corporation first.

Due Diligence (DD) on taxation and finance/tax planning for business regeneration

Assessing the financial health of target companies and identifying potential financial and taxation risks is an important part of the planning process prior to undertaking M&A or business regeneration. Silom Partners Tax Corporation offers a Due Diligence analysis designed to minimize the financial burden on the client via survey design (scope and methodology) predicated on optimum cost performance.

Due Diligence analysis for business regeneration

- Net assets

- Excessive debts

- Dividend rate

- Normalized earning

- Maintenance of loans and borrowings

- Potential tax risks

- Key challenges/obstacles

- Cash flow situation

- Available deficit

SPC consultancy services

Together with SLPI group companies we provide SPC consultancy services encompassing all aspects from set-up and ongoing management to closure.

Main services

- SPC set-up and registration

- Bookkeeping, accountancy, payments

- Company accounts and tax reporting

- SPC directors

- Monthly and quarterly reports

- Liquidation procedures

Foreign expansion consultancy—international taxation compliance, foreign subsidiary operations and local accountancy services

Silom Partners Tax Corporation advises Japanese companies on setting up subsidiaries overseas such as China, Hong Kong and Thailand, along with accountancy services and advice on international tax implications associated with cross-border transactions. With an extensive domestic and international network that includes SLPI group companies in Hong Kong and offices in major cities in China and Thailand, Silom Partners is uniquely positioned to provide on-the-ground assistance and support with overseas expansion plans.

Japanese subsidiary consultancy service

Silom Partners Tax Corporation advises foreign companies on setting up local branches or subsidiaries in Japan and also provides ongoing operational support, such as producing Japanese-language tax filings and accounting reports in accordance with local laws and regulations as well as English-language versions for submission to authorities in the origin country. We can also convert financial statements from JGAAP to IFIRS format if needed.

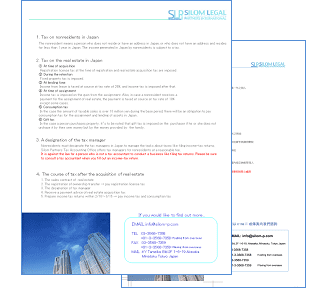

Support for tax managers and foreigners investing in real estate in Japan

- Income tax and other tax filings on behalf of Japanese nationals living overseas

- Accounting reports and tax filings on behalf of foreign investors with revenue-generating property in Japan

Tax guides for foreigners in English and Chinese (traditional and simplified)

Tax guides for foreigners in English and Chinese (traditional and simplified)

Outsourcing services

Outsourcing services include accountancy services such as bookkeeping and payroll.